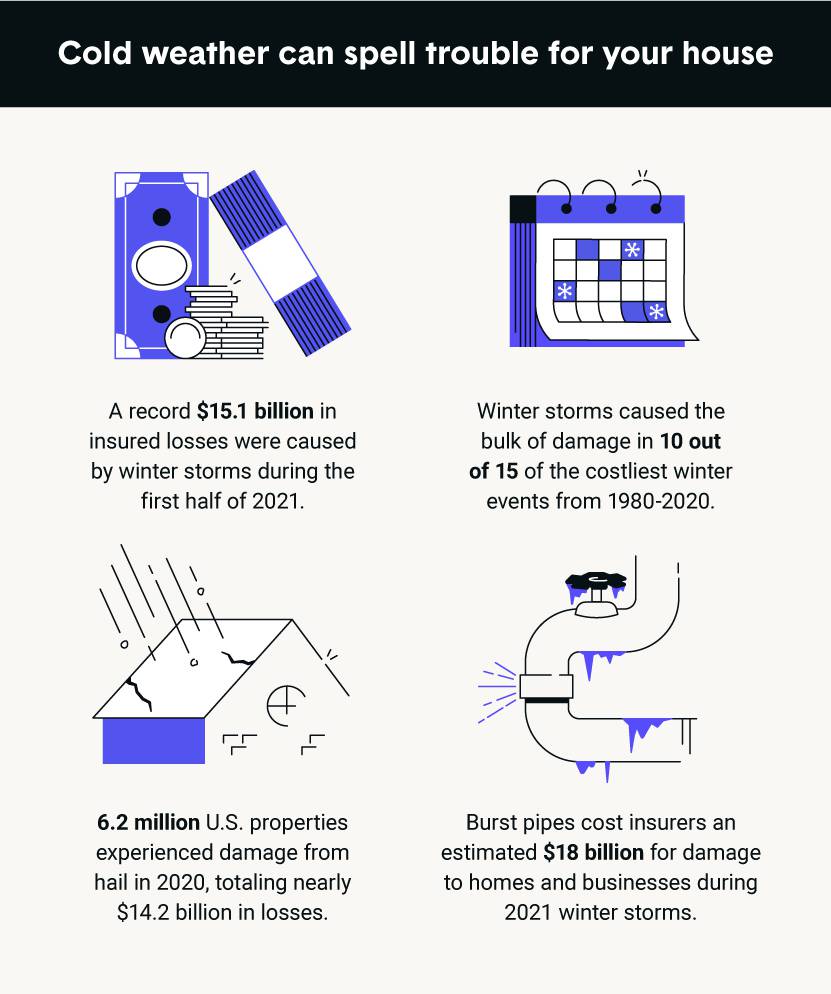

This year, proper home maintenance should be a priority for all homeowners. With the winter season upon us, many homeowners are bracing themselves for the impact that cold temperatures and harsh storms will have on their homes. Last year, more than a record $15.1 billion in “insured losses” were caused by winter storms, with power outages and water damage from burst pipes. (I wonder what were the “uninsured losses” were?)

Expensive damage from snow, wind, ice and water has led to costly home insurance claims that caused insurance premiums to raise dramatically, and in certain areas become unavailable. This is countrywide, and not just a CA, LA, or FL problem any longer.

With several major disasters and the spike in construction costs and labor, the insurance industry is approaching the “hard market” of the late 1990’s. What this means for the consumer is not good, and that increasing premiums and the unavailability of certain coverages are now going to be the norm.

And it turns out the “AI” relied on, and whatever other new data points they’ve conjured up, to “prevent or reduce losses,” is now actually being used to avoid paying losses…

So, check out what these new “rating variables” are that we think consumers will need to be aware of in the next few years to avoid the unaffordability of property insurance:

- Be fully aware & prepared that any of the insurance companies you may use can do an exterior inspection of your property and, now more than ever, are doing so. (What will they see, and do you want them to see or not see anything?)

- There’s certainly too much information out there, and the insurers always do a search online and discover things that are questioned. (Previous realtor data, social media info, and other online nonsense can cause havoc especially for landlords and businessowners).

- Do you or your neighbors have really tall trees that could conceivably land on your property? Well…the insurance companies might think so, and generally do. (They can see this from satellite images).

- Make sure that you have a roof less than 20 years old, regardless of the warranty, as insurers are even balking at properties with roofs older than 15 years old (They can also see this from satellite images and public records for permits in your municipality).

- Just because you may be purchasing a new property, the previous owners’ insurance loss history can count against you. (Always have your realtor check on this and work with an insurance agent to run reports to see “what’s out there”).

- Have anything on your property that is no longer being used? Well…get rid of it. Swing-sets, club houses, and other kid friendly items that are labeled as an “attractive nuisance” have become good reasons for insurers to cancel coverage or not give you coverage in the first place.

- Have a “back-up” system for your sump pump in case of power failure. (Some insurers will not offer Water Back-Up Coverage without this).

- Don’t have a Centrally Monitored System for burglar and fire? Economically feasible plans and features are now widely available and can help prevent many different types of losses. (Some insurers will not offer insurance on Higher Valued homes without these systems in place).

And, to help prepare your property to avoid or reduce loss, here are some tips for the upcoming winter months:

- Move any flammable materials, away from water heaters and wiring outdoors and in the basement that may have accumulated over the past few months.

- Insulate water pipes in areas exposed to cold temperatures.

- Check for damage to your roof, and clean gutters and downspouts to keep debris from accumulating. This is especially important during the fall season to keep leaves from building up in gutters and damning the flow of water out.

- Check and repair caulking around doors and windows that show signs of deterioration.

- Check caulking around showers, bathtubs, sinks and toilet bases; and make repairs as needed.

- Have your chimney cleaned and maintained annually by a professional.

- Clean and/or replace your furnace filter; have a technician service your HVAC unit.

- Clean the clothes dryer exhaust duct and space under the dryer. Pull the entire unit out and remove all lint, dust, and pieces of material in and around the area.

- Check your electrical outlets for potential fire hazards such as frayed wires or loose-fitting plugs. Be sure not to overload electrical outlets, fuse boxes, extension cords or any other power service.

- Identify that there are multi-purpose fire extinguishers accessible, filled and ready for operation.

- Inspect your smoke detectors. Make sure there is one on each floor of your home. Test them and change the batteries.

Lastly, what are some pitfalls of Property insurance policies in the winter?

Damage that occurs due to property owner negligence or failure of the owner to properly maintain or protect their property is never covered under your property insurance. Claims may be denied if no one was living at the property when the damage occurred or if reasonable care was not exercised to prevent the damage in the first place.